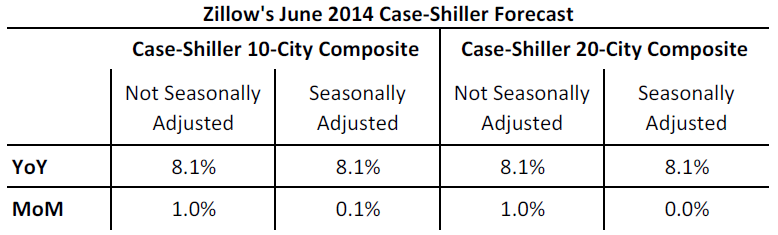

This month’s Case-Shiller surprised a bit with May month-over-month home price depreciation and a downward revision to the April numbers. This is more pronounced slowing than we have been seeing in previous releases. We expect this slowdown to continue to be readily present in next month’s release both on a year-over-year basis, which we expect to be close to 8 percent for June, as well as for monthly appreciation numbers. The Zillow Home Value Index has been showing home value appreciation slowing for quite some time with June home value appreciation at 6.3 percent on a year-over-year basis.

The Case-Shiller indices are biased toward the large, coastal metros – some of which are still seeing substantial home value gains, and they include foreclosure re-sales. The inclusion of foreclosure re-sales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. However, as the prevalence of foreclosures and foreclosure re-sales is declining, so is the impact they have on the Case-Shiller indices. Moreover, the fact that Case-Shiller uses a three-month average is strongly diluting the impact of the most recent numbers and with that the showing of a slowdown.

We expect home value appreciation to continue to moderate in 2014, rising 4.2 percent between June 2014 and June 2015, nationally. The main drivers of this moderation include rising mortgage rates, although these have been rising very slowly – and less investor participation – leading to decreased demand – and increasing for-sale inventory supply.

To forecast the Case-Shiller indices, we use the May Case-Shiller index level, as well as the June Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with June foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.